Despite the turbulence in international markets caused by the pandemic, Aventus Group’s lending grew by 66% in the first half of 2020. The Group is also looking for new business opportunities in new markets.

Andrejus Trofimovas, CEO of Aventus Group, shares how the Group managed to maintain business growth during the pandemic and tells how was the first half of this year for the Group companies.

Andrejus Trofimovas, CEO of Aventus Group

Due to the global pandemic situation, this year was and still is very challenging for most businesses. How do you assess the first half of this year – what experiences has this year brought to the Aventus Group business? What lessons have you learned, or maybe you saw new opportunities for business in these challenging times?

Andrejus Trofimovas: As I have said before, this is not the first crisis for the Aventus Group. Aventus Group was born during the crisis in 2009, so from the very beginning of this business, we know how important it is to mobilize the team and adapt the business to the changing conditions. When you are in business, you need to be prepared for challenges all the time, even when the economy is growing. I am convinced of that.

This pandemic crisis is unique in the sense that it is global and has chain consequences for almost every country’s economy. There is no single cure for all diseases, and there is no single recipe for dealing with the crisis. It is also difficult to project a long-term perspective on the consequences of a global pandemic crisis. But one thing is very clear – the larger the reserve the company will have, the easier the stage of overcoming the crisis will be. And in our case, this mindset and business planning paid off by 100%.

We have already shared with investors several times that the Aventus Group forms an up to 10% reserve of the total loan portfolio in cash, and that reserve was even increased in the face of the pandemic crisis. Aventus Group never borrows through P2P more than up to 45% of its total loan portfolio. We constantly follow these proportions and apply extremely strict discipline to ourselves. That Aventus Group not only talks about this business model but also puts it into practice can be confirmed by all PeerBerry investors who invest in Aventus Group loans through the platform. PeerBerry investors have never encountered defaulted loans, as such cases are resolved within the group. We are simply not putting such cases on the shoulders of investors. In terms of defaulted loans, the ratio of such loans in the group is 7% of the total loan portfolio, and it is one of the best indicators of defaulted loans in the entire short-term loan market.

Aventus Group never borrows more than up to 45% of its total loan portfolio through P2P.

Assets consist of a good portfolio, receivables, and cash on accounts.

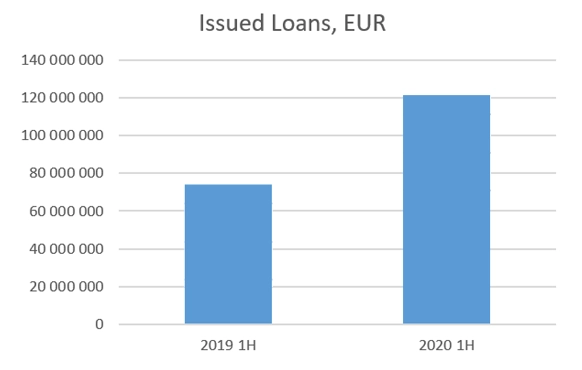

This crisis was not a lesson for the Aventus Group. It was another check that our business management mechanism is the right one and that we are on the right track. Despite global turbulence, this year is very positive for the Aventus Group. The total volume of the group lending increased by 66%, comparing the first half of this year with the first half of 2019. The number of employees grew significantly this year, the business volumes of the relatively new group companies increased, cash reserves increased, and the group operated profitably.

In which markets do you see lending businesses are doing best to deal with the challenges and ongoing consequences of the pandemic?

Andrejus Trofimovas: In general, the companies of Aventus Group operate smoothly in all countries. It is important to mention that a pandemic crisis is not just a pandemic that has a corresponding impact on the economies of all countries and specific businesses. In addition to the pandemic, many other reasons affect business in one way or another. For example, regulation or the political environment.

The regulation on lending business in Poland has been changed this year. However, this was no challenge for the Aventus Group at all – we have been preparing for these changes for a long time and have adapted our business accordingly. The profitability of Polish companies has slightly decreased, but Poland is still a very successful market for us.

We see that the lending business is shrinking more and more in many countries of the European Union, so countries outside the European Union still have great potential for developing the lending business.

In September this year, the Aventus Group reached a new milestone – the group becomes one of the biggest alternative finance groups in the EU by employing a team of 1000 members. What does such a big team mean to you, and how to effectively manage such a large business family?

Andrejus Trofimovas: We are ambitious to expand the business further, and our team will continue to grow accordingly. Gathering such a large team for a common goal and effective work is helped by a strong team of managers in each country. I can point out a very clear advantage of a large team – the bigger the team, the greater the competence of the organization. Each new team member enriches the organization with new visions, new insights, and new experiences and ultimately enriches the microclimate of the organization. Within the Aventus Group, we place great emphasis on internal communication. Every employee is welcome to share ideas, and the door to implementing good ideas is always open. I truly recognize that our team is a key strength of our business.

What are the key goals and business directions for the Aventus Group for the coming six months?

Andrejus Trofimovas: We will continue to focus on the effectiveness – in those countries where existing companies are profitable, and those where is a potential for further expansion through the establishment of new companies.

This year, the Aventus Group has been actively exploring the potential in emerging markets and is preparing to launch new businesses in the Philippines, Kenya, and India.

Comparison of loan volumes issued by Aventus Group

More information on Aventus Group’s business results for the first half of 2020: Aventus Group performance highlights H1 2020